Introduction: A Trade Policy Earthquake Unfolding in Real Time

April 2025 has delivered a seismic shift in global trade policy. Former President Donald Trump — now back in office — has reignited his protectionist agenda with sweeping tariffs that are shaking the foundations of financial markets worldwide. His bold strategy aims to boost domestic manufacturing, but the ripple effects are triggering widespread volatility across crypto and equity markets.

This blog breaks down the newest developments, analyzes market reactions, and highlights why RWA NOVA’s USDT Staking Pool could offer a much-needed safe harbor during these uncertain times.

April 2025 Tariff Tsunami: What’s New

In what’s being called a “new trade war era,” Trump officially implemented a 10% blanket tariff on all imports on April 2 — dubbed “Liberation Day.” That was just the beginning:

- 34% tariffs on Chinese imports

- 46% on Vietnamese goods

- 20% on products from the European Union

(All effective as of April 9)

And the pressure keeps building. As of April 12, the Trump administration is preparing an additional 25% tariff on foreign-made steel, aluminum, and vehicles, and is reportedly eyeing a crackdown on tech components and semiconductors next.

These moves, grounded in the International Emergency Economic Powers Act (IEEPA), aim to close trade deficits but have raised fears of retaliatory measures from allies like Canada, Mexico, and Germany — heightening global economic tension.

Market Reactions: Volatility Takes Over

Global markets are struggling to absorb the shock:

- Gold surged to a record $3,169/oz on April 3, signaling investor anxiety.

- The U.S. dollar seesawed, reflecting capital flight and uncertainty.

- Inflation forecasts have been revised upward, with some analysts warning of U.S. CPI exceeding 4.2% by early summer.

- Recession risk now stands at 35%, according to Goldman Sachs.

Social platforms like X (formerly Twitter) are flooded with reactions from panicked retail investors and institutional warnings — painting a picture of market instability not seen since early pandemic days.

Crypto Chaos: Risk-On Behavior Exposed

Once considered a hedge, the crypto market is clearly showing signs of correlation with traditional assets.

- Bitcoin (BTC) fell from $100,000 to $82,000, an 18% drop.

- Ethereum (ETH) dipped to $3,500, down 7%.

- Altcoins like Solana (SOL) and Cardano (ADA) dropped 10% and 8%, respectively.

- Total crypto market cap shrank by over $800 billion in just days.

Data from April 10 confirms Bitcoin’s correlation with the S&P 500 has risen to 0.88, weakening the argument for BTC as a “digital gold” — at least in this macro climate.

Wall Street Whiplash: Stocks Slide Deep

U.S. equity markets are taking a heavier beating:

- On April 3, the Dow Jones Industrial Average dropped 1,100+ points pre-market.

- The S&P 500 fell 13% in three sessions — its sharpest decline since 2008.

- Nasdaq suffered a 4.3% loss, driven by tech and consumer goods.

- Key players like Nike (-13%), GM (-7.8%), and Apple (-5.1%) are struggling amid cost concerns.

Investor sentiment has plummeted — with the latest AAII poll showing 60.6% bearish sentiment, the highest since the 2022 inflation spike.

What’s Next: Asset Classes on Edge

Here’s where the pressure may hit next:

| Asset | Impact |

| Gold | Likely to rise further as investors hedge against uncertainty. |

| Oil | Brent crude surpassed $74.85/barrel; supply chains may push it higher. |

| Tech stocks | High exposure to tariffs on chips and semiconductors. |

| Loan & Deposit Rates | Fed may consider hiking rates to fight inflation, affecting borrowing. |

Investors need to prepare for a market environment where capital preservation outweighs speculation.

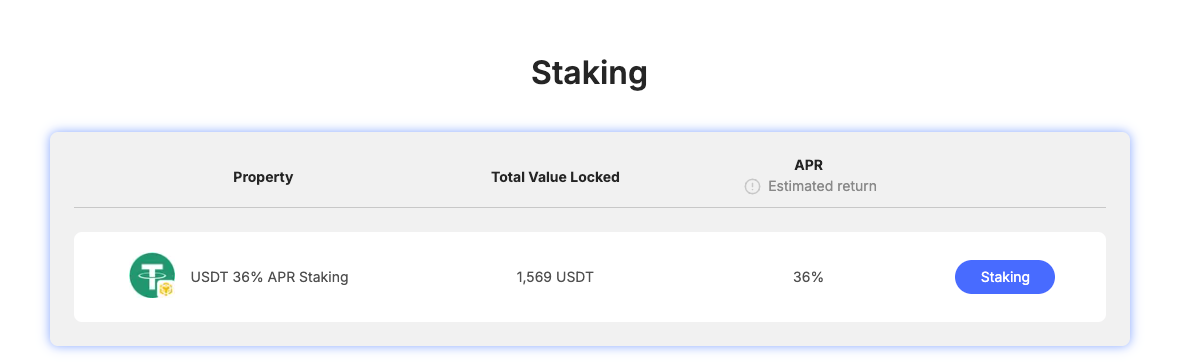

Why RWA NOVA’s 36% APR USDT Staking Pool Makes Sense Now

While traditional and crypto markets remain shaky, RWA NOVA’s USDT Staking Pool offers a rare combination of:

- Stability: Backed by USDT, a dollar-pegged stablecoin.

- High Return: A fixed 36% APR, far exceeding most traditional investments.

- Flexibility: Start with just $1, with no lock-up required.

- Incentives: Until April 15, early participants receive up to $100 in bonus NOVA tokens, with an extra 10% boost if they stake within 24 hours.

This makes RWA NOVA’s pool one of the most competitive low-risk options in a time where even bonds and blue-chip stocks are seeing sharp declines.

Final Thoughts: Rethinking Your Investment Strategy

The 2025 tariff wave has changed the game. Whether you’re a stock trader, crypto investor, or cautious saver, now is the time to reallocate with intention.

Stability, yield, and flexibility — those are the new investment pillars.

While markets may eventually recover, the timeline is unclear, and volatility is likely to continue. In the meantime, RWA NOVA’s USDT Staking Pool provides a rare anchor — strong yield, low risk, and immediate reward.

👉 Ready to stake your claim in this new economic era?

Explore the RWA NOVA Staking Pool and secure up to 36% APR — today.