In the ever-evolving world of crypto staking, stablecoin yields are getting tighter — and savvy investors are starting to ask:

“Where can I actually earn from USDT in 2025?”

We looked into the numbers, compared the major platforms, and here’s what stood out.

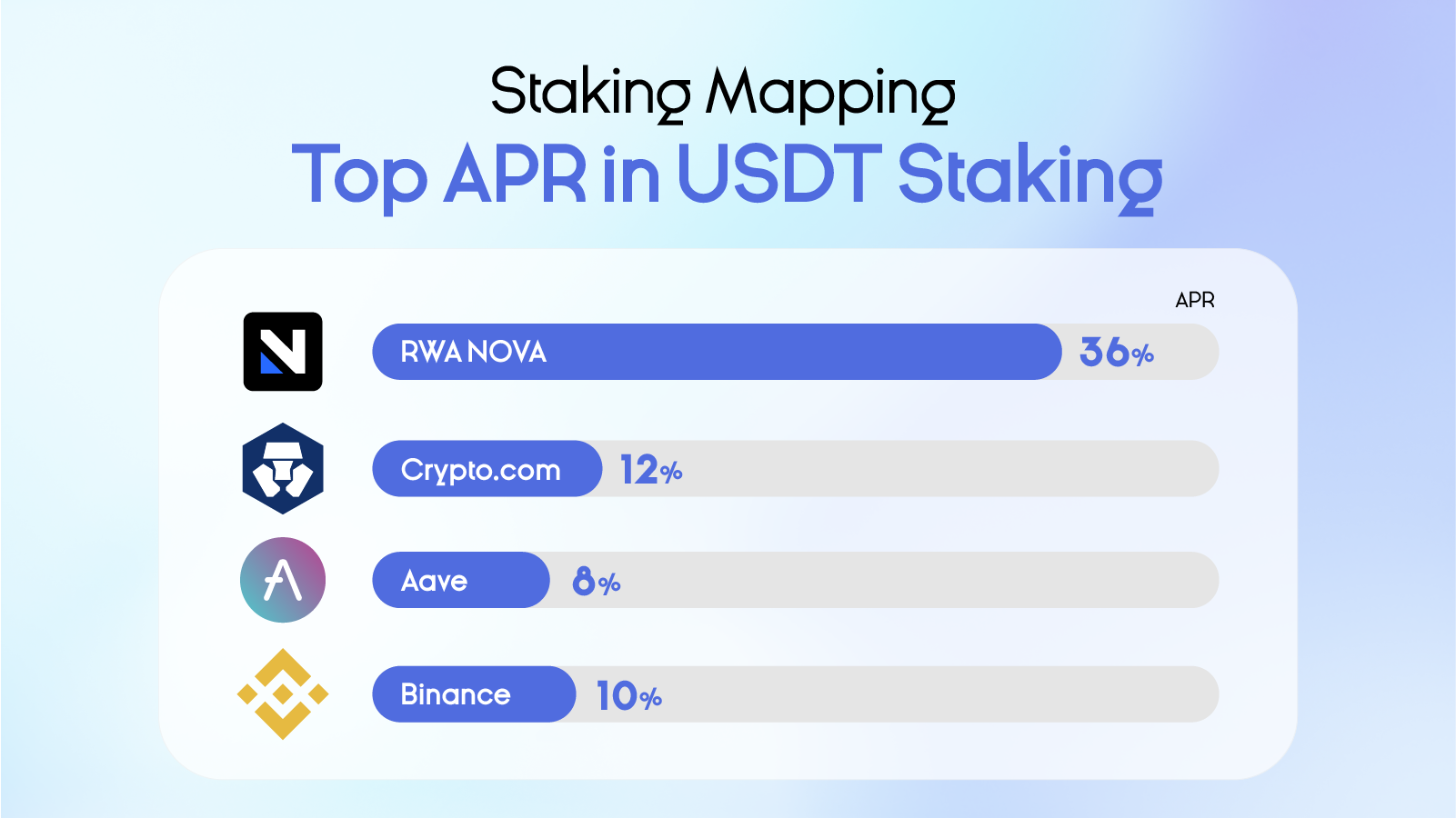

📊 2025 USDT Staking APR – A Side-by-Side Comparison

| Platform | APR (Annual Percentage Rate) |

| RWA NOVA | 36% |

| Crypto.com | 12% |

| Binance | 10% |

| Aave | 8% |

While many platforms hover in the 8–12% range, one name quietly rises to the top: RWA NOVA, offering a 36% APR on USDT staking.

And no — it’s not a typo.

🧠 But How Is That Possible?

RWA NOVA isn’t just another DeFi protocol. It’s building an ecosystem around tokenized real-world assets (RWAs) — think real estate, bonds, and off-chain assets brought onto the blockchain. Their 36% APR is part of an early-phase rewards program designed to bring liquidity and attention to their staking pools.

The team has also been gaining traction, most recently appearing as an official sponsor at TOKEN2049 Dubai 2025, signaling credibility and long-term vision — not just short-term hype.

🧐 Should You Trust It?

That’s the right question to ask — and it’s what separates smart investors from reckless ones.

Here’s why people are starting to give RWA NOVA a serious look:

- Transparent staking mechanics with daily snapshots

- Flexible unstaking options

- Backed by the growing RWA narrative (which even TradFi is paying attention to)

- Early adopter benefits before institutional players join in

🧭 Final Takeaway: Read the Fine Print, But Don’t Ignore the Signal

We’re not here to tell you what to buy — but when one platform offers 3x the average APR, it’s worth doing your own deep dive. Especially if you’re looking to make your stablecoins work harder this year.

📌 Start your own research now at rwanova.io/staking