What Are Real World Assets (RWAs) and Why Is Everyone Paying Attention?

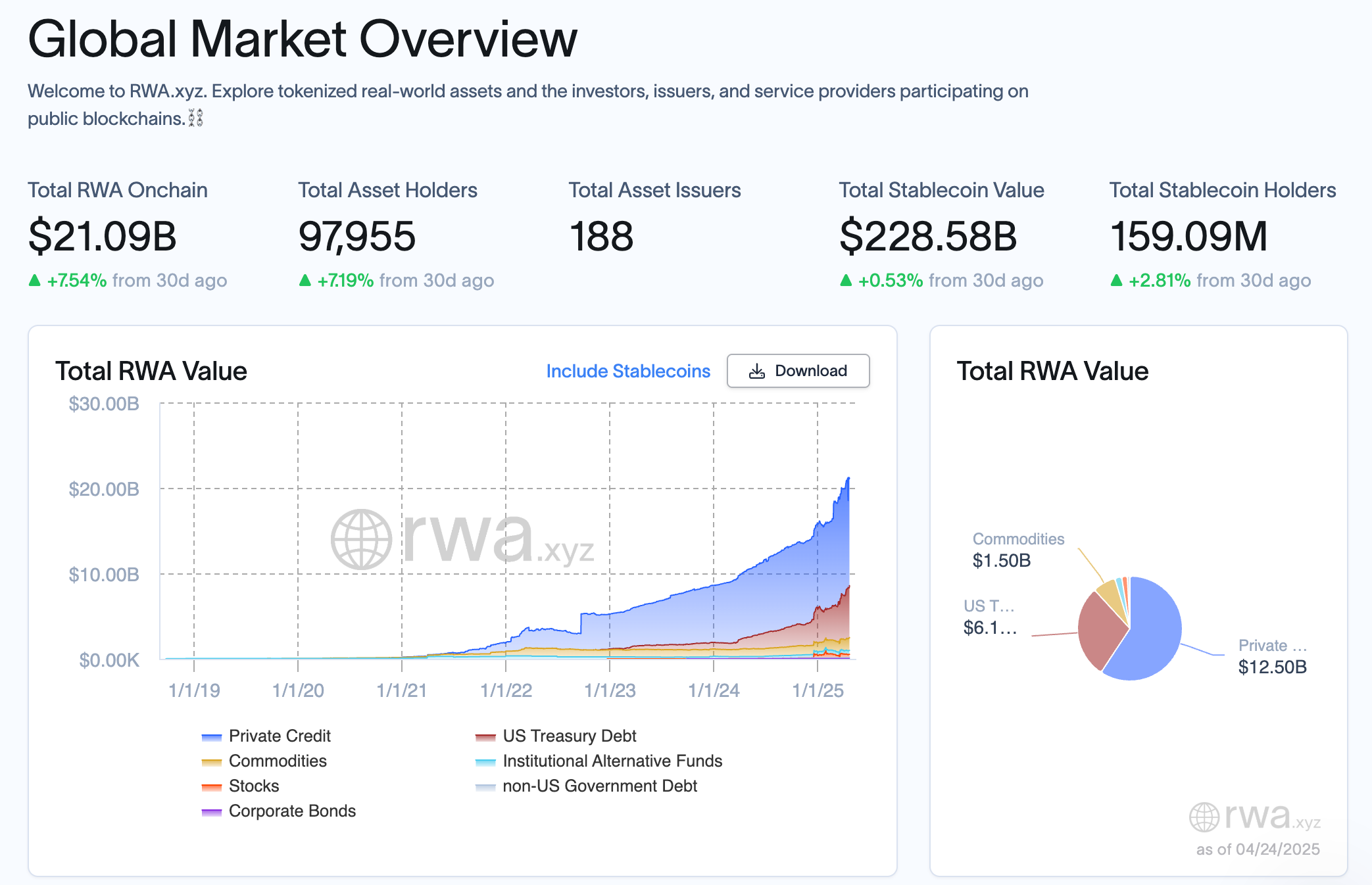

In the past year, Real World Assets (RWAs) have emerged as one of the fastest-growing sectors in crypto. As of April 2025, over $20.9 billion in tokenized real-world assets are locked across major protocols—up from just $760 million at the beginning of 2024 (source: RWA.xyz).

This exponential growth has sparked widespread interest among institutional investors, DeFi users, and everyday crypto enthusiasts alike.

But what’s driving this trend—and what role will RWAs play in the future of decentralized finance?

Tokenization: Bridging Traditional Finance and DeFi

At its core, the RWA movement is powered by tokenization—the process of converting tangible assets such as real estate, bonds, and private credit into digital tokens on the blockchain.

This innovation allows traditionally illiquid or inaccessible assets to be traded more easily, transparently, and globally. For the first time, everyday investors can participate in financial markets that were once limited to institutions and high-net-worth individuals.

2024: A Breakout Year for RWA Growth

Several key developments helped RWA adoption take off last year:

- Institutional participation: Financial giants like BlackRock, Goldman Sachs, and Franklin Templeton began integrating tokenized assets into their portfolios.

- Asset diversity: Beyond real estate, RWAs now include tokenized credit products, invoices, treasury bills, and more.

- Greater accessibility: Protocols such as Ondo Finance, Centrifuge, and PACT have made it easier for both institutional and retail users to access tokenized investment opportunities.

These platforms have laid the foundation for the next generation of blockchain-based finance.

Why Institutions Are Embracing RWA Technology

The shift toward RWAs isn’t just hype—it’s backed by serious strategic investment.

“The next generation of markets will be powered by tokenization.”

Institutions are increasingly turning to RWAs because they offer:

- Real-world collateral and reduced volatility

- Faster and cheaper settlement processes

- Enhanced transparency and auditability

- Broader global access to financial instruments

Projects like Centrifuge, which has been tokenizing credit markets since 2017, and Ondo Chain, a blockchain purpose-built for institutional tokenization, have strengthened trust in the ecosystem.

How RWA NOVA Is Expanding Access

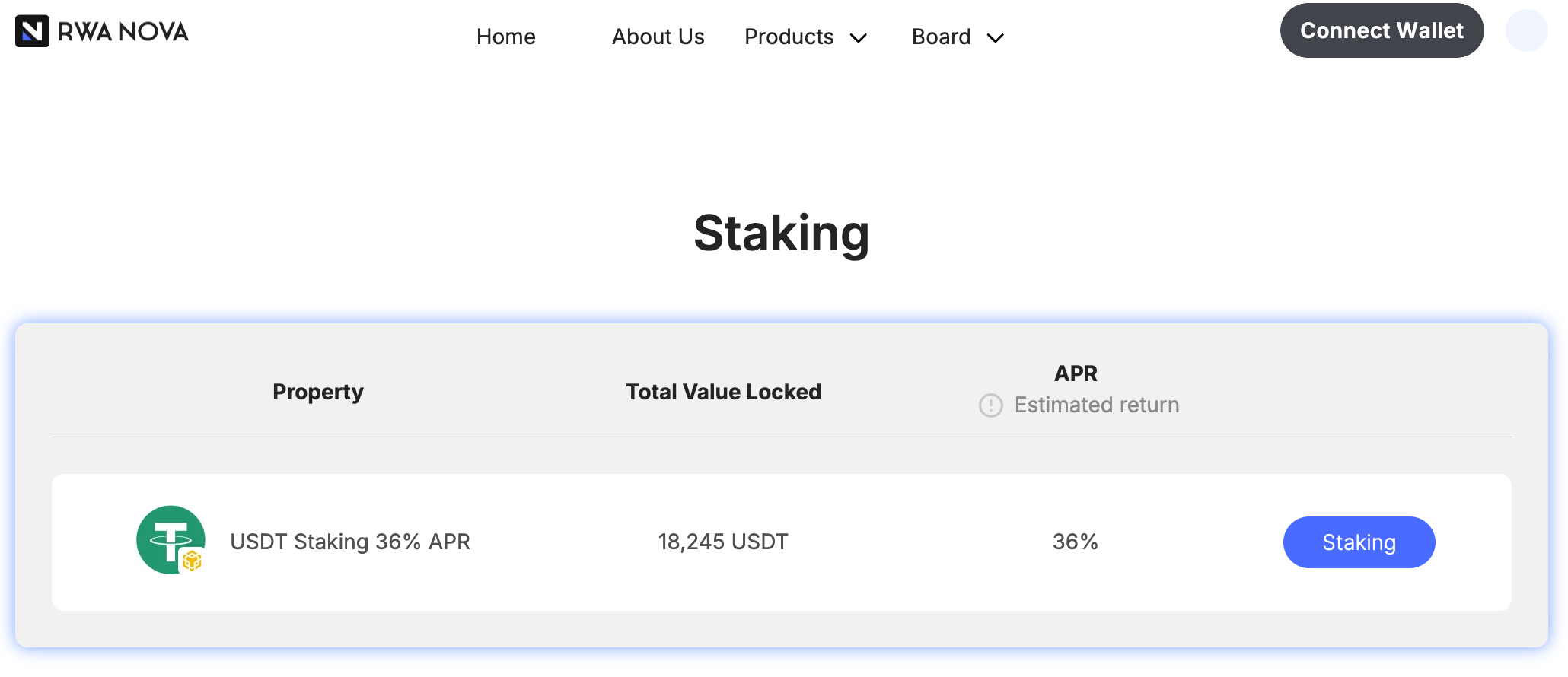

At RWA NOVA, we believe tokenization should be available to everyone—not just institutional investors.

Our platform provides a simple, transparent way to earn yield on real-world backed assets. Currently, users can stake USDT and earn up to 36% APR through our RWA-based staking pool.

Whether you’re new to crypto or already a seasoned DeFi user, RWA NOVA makes it easy to participate in tokenized finance with just a few clicks.

Learn more: rwanova.io/staking

What’s Ahead: The Future of the RWA Market

Market forecasts suggest that RWAs could reach $10 trillion in market size by 2030. As global regulations mature and more asset types become eligible for tokenization, we expect to see:

- The launch of new financial products built on RWA infrastructure

- Greater DeFi–TradFi integration

- Community-led governance models for tokenized asset pools

In short: the RWA market is only just beginning to scale—and it’s moving fast.

Conclusion: Why Now Is the Time to Pay Attention

Real World Assets are no longer a theoretical concept—they’re here, they’re growing, and they’re changing how we invest.

Platforms that offer accessibility, transparency, and real value—like RWA NOVA—are positioned to lead the next wave of blockchain finance.

If you’ve been waiting for a sign to get involved in crypto-backed real-world assets, this might be it.

Start earning, start diversifying, and be part of the financial future today.

Want to learn more about RWA NOVA : rwanova.io