2025 is shaping up to be an extraordinary year for blockchain, as three key narratives are poised to dominate the crypto landscape: Real-World Assets (RWA), Decentralized Physical Infrastructure Networks (DePIN), and the rise of AI agents. Each of these trends represents a groundbreaking shift in how we interact with technology, invest in digital assets, and build the future of decentralized systems. Let's dive into why these narratives will not only define 2025 but also ignite the next crypto bull run.

1. RWA: The New Frontier of Asset Tokenization

Real-World Assets are rapidly emerging as a cornerstone of blockchain adoption. By tokenizing physical assets like real estate, art, commodities, and even carbon credits, RWA bridges the gap between the digital and physical economies. Here’s why RWA is set to explode in 2025:

- Institutional Adoption: Major players in traditional finance are moving into the blockchain space. Firms like BlackRock and JPMorgan have already dipped their toes into tokenized assets, signaling the start of institutional adoption.

- Regulatory Clarity: Governments worldwide are beginning to establish frameworks for RWA, providing the legal certainty needed for mass adoption. This will unlock trillions of dollars in illiquid assets.

- DeFi Meets RWA: Platforms integrating RWA with decentralized finance (DeFi) protocols are offering new financial opportunities. Investors can now use tokenized real estate as collateral for loans or earn yield on tangible assets.

In 2025, expect to see exponential growth in the RWA market, with blockchain-based marketplaces and DeFi platforms leading the charge. The narrative of tokenizing the world is no longer a dream—it’s a reality.

Reference : https://iotex.io/blog/what-are-decentralized-physical-infrastructure-networks-depin/

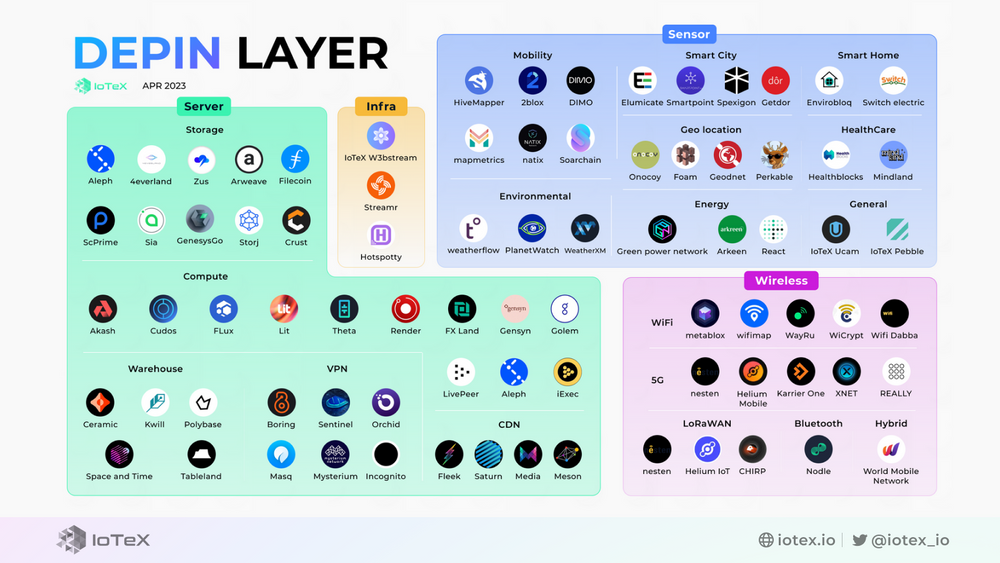

2. DePIN Coins: Powering the Physical World

Decentralized Physical Infrastructure Networks (DePIN) represent a new paradigm in blockchain—one that extends decentralization into the physical world. Unlike traditional projects that focus purely on digital applications, DePIN focuses on real-world infrastructure such as:

- Energy Grids: Tokenized solar farms and decentralized power grids.

- IoT Networks: Community-driven networks like Helium, enabling secure IoT data transfer.

- Transportation: Decentralized logistics solutions for global supply chains.

What makes DePIN a game-changer is its ability to reward participants for contributing to physical infrastructure. For example, individuals can earn tokens by hosting network hardware, providing bandwidth, or generating renewable energy.

In 2025, DePIN coins will gain massive traction as they offer:

- Passive Income Opportunities: Users can earn rewards by contributing to critical infrastructure.

- Sustainability: Many DePIN projects align with global ESG goals, attracting environmentally conscious investors.

- Real-World Utility: Unlike many crypto projects, DePIN coins have tangible use cases that benefit industries and consumers alike.

DePIN is set to revolutionize how we think about infrastructure, making 2025 a breakout year for projects in this space.

3. AI Agents: Redefining Automation and Interaction

The fusion of AI and blockchain is another unstoppable trend, with AI agents emerging as autonomous entities that can interact with decentralized systems. These agents are transforming:

- DeFi: AI agents can optimize yield farming strategies, manage portfolios, and execute trades autonomously.

- RWA Management: AI can streamline asset valuation, property management, and market analysis for tokenized assets.

- Customer Interaction: AI-driven chatbots and virtual assistants can now operate on blockchain, offering trustless and secure interactions.

Why will AI agents dominate in 2025?

- Efficiency: AI agents eliminate human error and work 24/7, making them invaluable in finance and operations.

- Personalization: They provide tailored solutions for investors, users, and developers.

- Integration: As blockchain ecosystems grow, AI agents will become essential in managing the increasing complexity of decentralized systems.

With advancements in GPT models and other AI technologies, 2025 will be the year where AI agents become a standard feature across blockchain applications.

Why 2025 Will Be a Bull Market

The convergence of RWA, DePIN, and AI agents creates a trifecta of innovation that will drive unparalleled demand in the crypto market. Here’s why these narratives will ignite a bull run:

- Mass Adoption: These technologies solve real-world problems, attracting both institutional and retail investors.

- Revenue Generation: Projects in these areas generate tangible value, fostering sustainable growth.

- Network Effects: As more participants join these ecosystems, their value and utility will grow exponentially.

Moreover, with the global economy recovering and regulatory clarity improving, the stage is set for a crypto resurgence. Investors seeking groundbreaking opportunities should keep their eyes on RWA, DePIN, and AI agents—the pillars of the 2025 bull market.

Conclusion

2025 is more than just another year in the crypto timeline; it’s a turning point. The rise of Real-World Assets, DePIN, and AI agents signifies a shift from speculative projects to real-world utility. These narratives are not just trends; they are the foundation of the next wave of blockchain innovation. For those ready to embrace the future, the time to act is now. The bull market is not just coming—it’s already on the horizon.