Real World Asset (RWA) tokenization is still one of the buzziest topics in 2025. It’s no longer some far-off idea—traditional assets and blockchain are blending, and big players are getting involved. But for a lot of individual investors, it can feel a little overwhelming. What exactly is RWA? Why does it matter now? And where do you even start?

Here’s a quick and easy breakdown of the big RWA trends to keep an eye on this year—from a fellow investor’s perspective.

📊 Trend 1: Big Institutions Are In

Over the past year, major players like BlackRock, HSBC, and Citi have jumped into RWA projects or started building infrastructure around it. That’s a huge sign of credibility—and stability—for the space.

Why it matters: When the big guys show up, you know it’s not just experimental anymore. That usually means lower risk and more long-term potential for everyday investors like us.

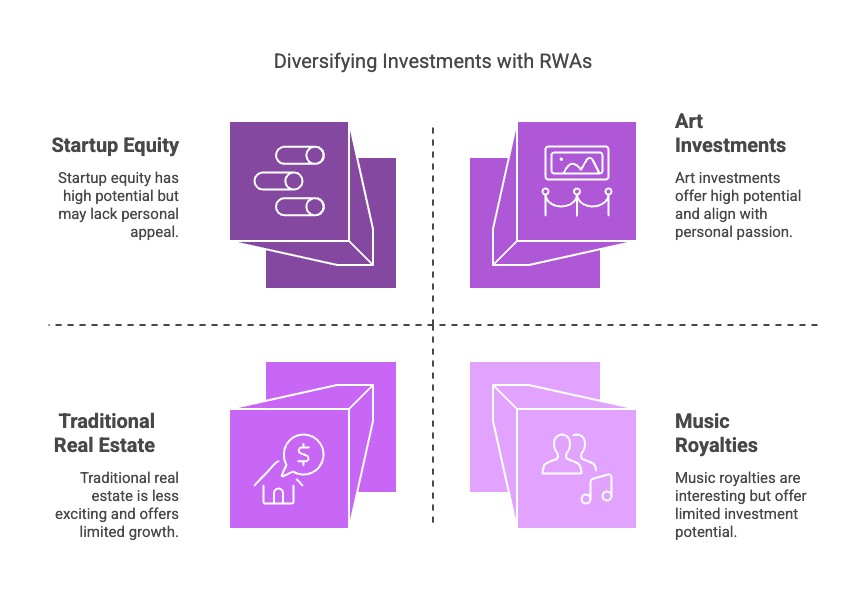

🔄 Trend 2: Way More Than Just Real Estate

At first, RWA was mostly about tokenizing real estate or government bonds. But now? We're seeing everything from art and wine to music royalties and startup equity. That means more chances to invest in things you actually care about.

Why it matters: You can now tailor your portfolio to your interests. Love art? There’s a project for that. Into startups? Same deal. It’s a fun (and smart) way to diversify.

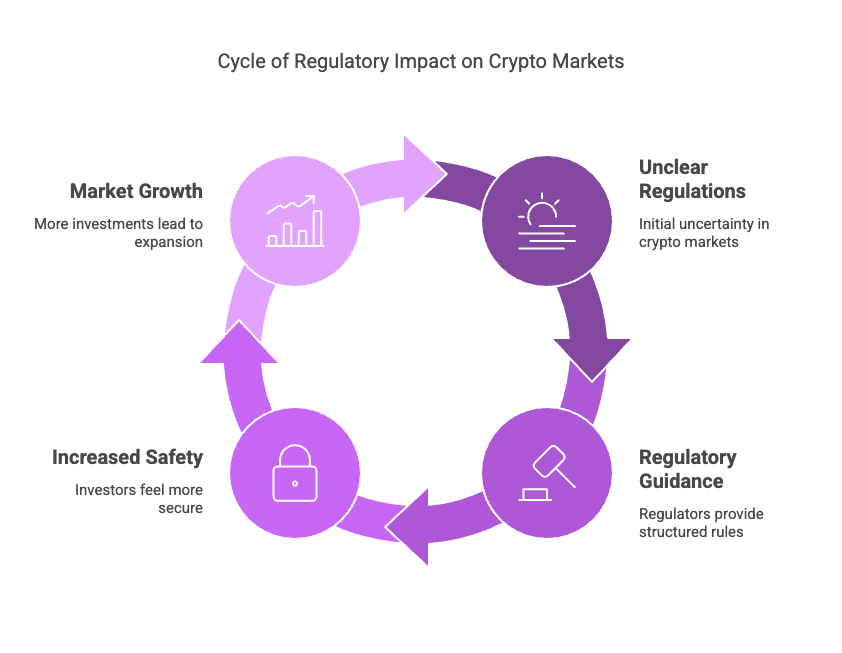

📈 Trend 3: Clearer Rules = More Confidence

One of the biggest hold-ups in crypto investing has always been unclear regulations. But now, regulators like the SEC (U.S.) and MAS (Singapore) are giving more structured guidance on RWAs. That’s helping calm nerves.

Why it matters: Clear rules mean more safety. And when a market gets regulatory clarity, it usually grows faster—because people feel better about putting their money in.

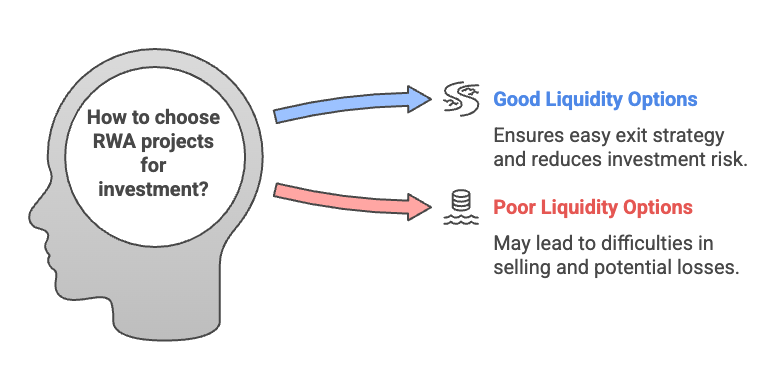

💡 Trend 4: It’s Getting Easier to Trade

RWA markets used to be super illiquid—it was hard to sell once you bought in. But things are changing fast. DEXs, peer-to-peer trading, and better market-making tools are making RWAs easier to buy and sell.

Why it matters: Always think about your exit strategy. If you're putting money in, you’ll eventually want to get it out. Look for projects with good liquidity options.

🚀 Trend 5: Finally—Platforms That Make Sense

Let’s be real—crypto investing can be confusing. But now there are platforms (like RWA NOVA) that make it really easy to get started. You don’t need to be a DeFi expert to get involved.

Why it matters: A simple, transparent platform can make all the difference—especially if you're just starting out or don’t want to deal with technical headaches.

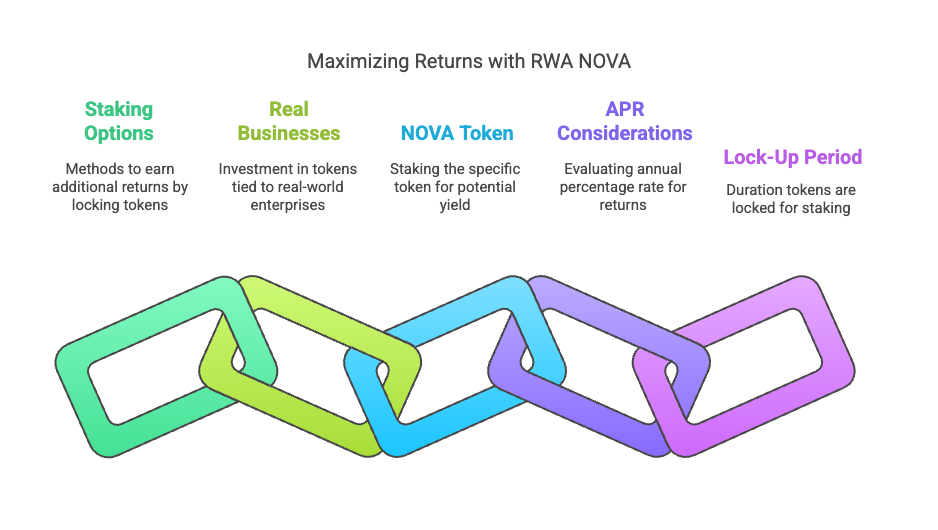

💸 Bonus: Staking Options for Extra Yield

Aside from investing in RWA-backed projects, RWA NOVA also offers staking options that can give you additional returns. Whether you're staking tokens tied to real businesses—like restaurants or eco-waste solutions—or the NOVA token itself, it's a great way to put your assets to work.

Why it matters: If you're already planning to hold onto certain tokens, staking can boost your passive income. Just make sure to check the APR and lock-up period to match your investment goals.

📅 Wrapping Up

2025 could be the year RWA investing really takes off. Sure, there are still risks—it’s early days. But there’s also a lot of opportunity. The key is staying informed, trusting your timing, and picking the right projects.

Curious where to begin? Start exploring with RWA NOVA—the smart, easy way to get into real-world asset investing.

If you want to learn more about RWA NOVA click here :) https://rwanova.io/